In the first post in our Recession-Proofing Your Profit series, I shared the basic structure of Term Renewal Acceleration, in which a product manager creates an offer to accelerate an annual term renewal with a limited duration renewal discount. In this post, I will expand on the basic structure of Term Renewal Acceleration to show how adding advanced customer segmentation based on product usage data can further increase profitability. Subsequent posts will cover the Multi-Term Acceleration and Pre-Term Development techniques.

My first post developed a basic model of term renewal acceleration by offering all customers a 10% early renewal discount. Unfortunately, this simple approach means that power users who don’t need the offer, because they are highly likely to renew, may take the offer. In contrast, infrequent users who may need a more significant offer to motivate a renewal will ignore it. In both cases, our total potential revenue is lower.

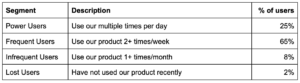

To resolve these problems we’ll first segment our customers based on product usage data.

Infrequent Users and Lost Users are a low percentage of the user population (10%) because the company does a good job of onboarding users and supporting them to gain mastery and promote loyalty. However, Infrequent and Lost Users do exist, and every bit of revenue counts. The correct discount at the right time may motivate these customers to renew!

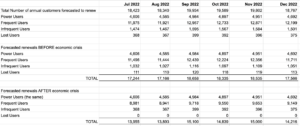

After segmenting the users, we can develop a more effective promotional campaign. Expressly, we’ll exclude Power Users from our campaign assuming that Power Users will renew their term when it finishes without the need for a discount. The remaining segments will be given discounts tailored to their usage patterns with the deepest discounts being given to Infrequent Users and Lost Users in an effort to entice the least motivated customer. We’ll also add average churn before economic hardship, forecast churn due to the economic crisis and forecast the percentage of customers who renew early to take advantage of our multiple attractive offers.

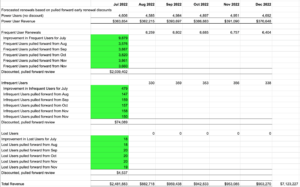

Next, we’ll look ahead at how many customers in each segment are due for renewal in the next six months and forecast renewals based on churn rates before and after the economic crisis.

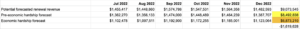

Next, we’ll model revenue under several circumstances: no churn, pre-economic hardship, and as a result of economic hardship (based on average annual renewal) in this example, $79.

The result is a potential loss of $1,619,628. We now need to calculate, by customer segment, how many customers we can pull forward to renew in July based on the offer. We exclude Power Users from the offer because we assume they will renew without any offer (and, remember we aren’t going to give them an offer). In the rows below, users who renew as a result of the offer are in green. They get a lower price (or greater percentage off) to renew early.

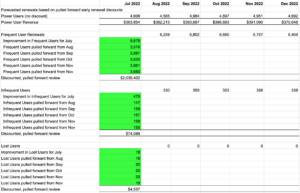

The final step is to calculate the expected revenue resulting from each offer.

While we’re still facing an overall revenue decrease, the segment-based discount offer reduces the shortfall by $250,017. This shows that using data-driven customer segmentation and providing an attractive offer for each segment can preserve a significant amount of revenue when faced with a challenging economy – the first step in achieving sustainable profits!

For more product management insights, check out our Product Management Accelerator, Scrum foundational and advanced Product Owner education, and SAFe Product Owner, Product Management, and Lean Portfolio Management education.

Interested in using Term Acceleration Renewal? Download the Recession Proof Your Profit Template (.xlsx)